Home Improvement Loans

Find the right home improvement loan for you

Home improvement loans to turn those dreams into a reality.

We are a credit broker, not a lender.

What are home improvement loans?

Home improvement loans are designed to help pay for upgrades and renovations around your house. This may add value to your home, which could be considered an investment.

A home improvement loan could be the boost your funds need to kickstart that big decorating job or make your dream kitchen a reality.

Are there different types of home improvement loans?

Yes, there are. Home improvement loans can be secured and unsecured.

We’ll explain a little about each below.

A secured home improvement loan could be an option if you are looking to borrow a large amount of money for a big project, such as a refurbishment, for example.

When you take out a secured loan, you are borrowing money against one of your assets, usually your home; this is referred to as ‘collateral.’ This means that if you default on your repayments, the lender is within their rights to recover their losses by seizing the collateral.

You should think very carefully before securing your home against any borrowing.

An unsecured home improvement loan does not require any form of collateral, so if the unexpected happens and you fall behind on your repayments, you will not run the risk of losing your home. However, you should remember that missing a payment, or making a late payment, will affect your credit score.

An unsecured loan could be an option if you’re looking to borrow money over a shorter term.

How do home improvement loans work?

Shop around for a suitable loan or save time by using a credit broker to compare loans you could be eligible for.

If approved, use the money to pay for your home improvements.

Repay the loan in monthly instalments until the balance is fully cleared.

Things to think about before applying for a home improvement loan

- Before you apply for a home improvement loan, you must be sure that you can afford to make the monthly repayments. If you are late making your repayment, or miss a payment altogether, you could be charged a fee by the lender and your credit score will be affected.

- Never apply to borrow more money than you actually need or can comfortably afford to repay.

Who can apply for a home improvement loan?

Each of our lenders have their own criteria when it comes to applying; however, generally, you should:

- Be over the age of 18;

- Have a minimum annual income of £5,000;

- Have a UK address with three years' worth of UK address history;

- Have a UK-issued bank account with a valid debit card; and

- Be employed, with your income paid directly into your bank account.

Finding the best home improvement loan for you

Taking out a loan is a serious financial commitment and not a decision that should be taken lightly. You should do thorough research and compare your options before you apply so you’re sure you’re making the right decision.

Don’t rush into applying for the first loan you find; take your time, shop around, and compare different loan terms and interest rates

It’s worth remembering that you may not necessarily be offered the Representative Annual Percentage Rate (APR) as advertised. The interest rate you are offered will be personal to you and your circumstances, and will be based on your financial history and credit score.

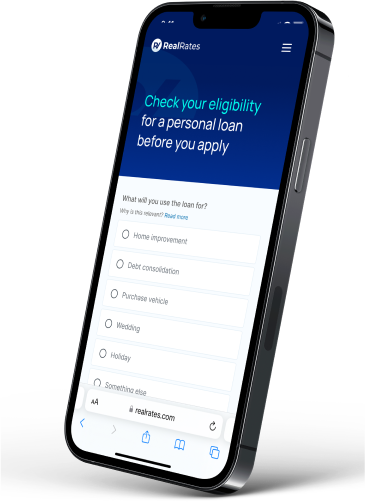

Why use Real Rates to compare home improvement loans?

We work with a range of lenders who offer home improvement loans between £2,500 and £50,000 across terms between one year and seven years, depending on the amount you borrow.

Tell us a bit about your circumstances by completing our online eligibility check. Using the information you’ve provided, we can compare interest rates, loan amounts, and terms to tailor your results and find the loan that’s right for you.

Our soft search will not impact your credit score.

The Real Rates process

Tell us a bit about yourself

Complete our online eligibility check form - this shouldn't take longer than 5 minutes.

Let's get this show on the road

We'll check your eligibility using soft search technology and reveal your results in just 60 seconds.

It's a match

If approved, select the loan you'd like to apply for, and you'll be redirected to the lender's

website to complete a full application and a hard credit search.

Frequently Asked Questions

Each lender has their own timeframe when it comes to sending your loan.

Some lenders will send the money on the same day the application is approved; however, the time it takes for funds to show as available in your account will depend on your bank’s policies and procedures.

Many lenders will allow you to repay your loan early if you wish to do so; however, some companies may charge an early repayment fee. Check the terms and conditions of your loan carefully to avoid any unexpected charges.

In general, the higher your credit score, the higher your chance of being approved for a loan.

If your need for money is not absolutely urgent, you might want to work on improving your credit score before you apply for a loan.

There are a number of ways to boost your credit score.

- Make sure that all your bills and any current credit accounts are paid on time.

- Register to vote;

- Check your credit report for errors. If you notice a mistake, contact your credit reporting tool and ask for this to be corrected.

- If you have a credit card, aim to stay well within your limit and make at least the minimum repayment amount on time every month.

- When you apply for a credit product, the lender will run a hard search with every application. Try to avoid multiple hard searches over a short period of time, as this will affect your credit score.

You can also find free, impartial advice on money and debt management on various sites, such as MoneyHelper, StepChange, National Debtline and Citizens Advice Bureau.

Like all credit products, a home improvement loan can alter your credit score.

If you make your repayments on time each month and repay your loan in full as agreed, you may see an improvement in your score.

On the other hand, if you fall behind on or fail to make your repayments, it’s probable that your score will decline.

We’re sorry that you’re in this position; please know that you are not alone and there is help and advice available. You should contact your lender as soon as possible. They will want to work with you to find a solution.

Talking about money worries can be daunting, but there are organisations that can help, such as MoneyHelper, Citizens Advice Bureau and National Debtline.

For impartial guidance on money and debt management, head over to StepChange. Here, you can also complete a free, online quiz, and the answers you provide will generate advice to support your next steps.