COMPARE NOW

Compare personal loans.

Loans between £1,000 and £50,000.

We are a credit broker, not a lender.

You’re in good hands.

We work with a wide range of trusted providers offering loans between £1,000 and £50,000.

No more guessing

We remove the guesswork, showing you personalised results from a range of loan providers.

Our soft search will give you an idea of how likely you are to be approved for a variety of loans, with no impact to your credit score.

Compare with ease.

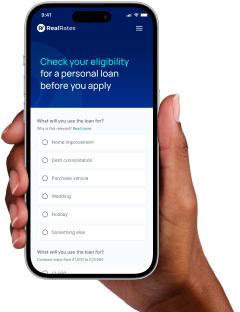

Our simple form is 100% online so you can check your eligibility no matter where you are

Whether you're on the train or your lunchbreak, our online application form makes it easy to check your eligibility in under five minutes.

Ready to start comparing loans?

Comparing loans can be time-consuming and confusing.

Leave it to us.

Our process is straightforward

Taking out a loan is a serious financial commitment. Falling behind on or failing to make your pre-agreed monthly repayments could lead to late fees and charges, a decline in your credit score, and increased financial strain. Never borrow more than you need.

Let’s get to know each other.

Complete our online form – this should take no longer than 5 minutes.

We’ll do our thing.

Using a soft credit search, we will check your eligibility and reveal your results in just 60 seconds.

It’s a match.

Select the loan you’d like to go ahead with, and you’ll be redirected to the lender’s website to complete your application.

Image is for illustrative purposes only

Loan purposes

There are lots of loans out there - find the one that works for you.

Frequently Asked Questions

Real Rates is part of the Comparitec Group of companies which, collectively, has processed over 27 million loan applications since 2013. Real Rates is a credit broker, working with a range of trusted lenders to find loans to suit you and your circumstances, based on the information you provide to us.

You can check your eligibility for a loan if you:

- Are over the age of 18;

- Have a minimum annual income of £5,000;

- Are a UK resident with a UK address;

- Have three years' worth of UK address history;

- Have a UK-issued bank account with a valid debit card; and

- You are employed, with your income paid directly into your UK bank account.

To check your eligibility for a loan, Digitonomy (trading as Real Rates) will carry out a soft search on your credit file to match you with the most suitable lender(s) on their panel; the lender(s) may also carry out a soft search to assess your eligibility for the product you are looking for. These searches will only be visible on your credit report to you, and they will not affect your credit rating.

If you need help, or have any questions about the application process, please contact the Real Rates Customer Service team using our online form.

When applying for a loan, a good credit score could mean that you are presented with loan options from a range of lenders, allowing you to compare offers to find the one that suits you. You could also be offered a loan with a better rate of interest.

Our lenders offer loans between £1,000 and £50,000, with terms between one and seven years depending on the amount you apply to borrow.

You should never borrow more money than you need, and you should be confident that you are comfortably able to make your repayments each month without this affecting your essential bills, such as rent or mortgage, food, and utilities.

The overall cost of your loan will depend on the Annual Percentage Rate (APR) you are offered, how much money you borrow, as well as your loan term.

APR stands for Annual Percentage Rate and refers to the overall annual cost of your loan, including interest.

The Representative APR gives you an idea of the overall cost of the loan, including interest and any annual fee, if applicable. This is the rate, or lower, that 51% of customers have been offered for the financial product that is being advertised. If your application is successful, you may not necessarily be offered the Representative APR; your rate of interest is personal to you and could be higher or lower than the advertised rate.

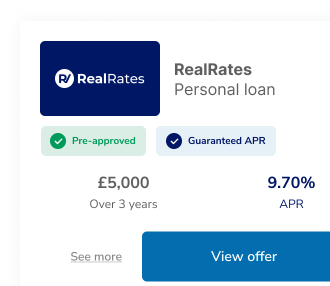

When you check your eligibility for a personal loan and are accepted by a lender, they may offer you a 'Real Rate' or 'guaranteed rate'. Unlike representative rates, this means that the rate offered will not change after you make a full application; this is subject to acceptance by the lender following a hard search and any other applicable checks.

A soft credit search is used by credit brokers to determine how likely you are to be approved for a credit product, such as a loan or credit card, before you apply directly with a lender or credit card provider.

The search will only be visible on your credit file to you and the company who carried out the check and will not have an impact on your credit score.

A hard credit search is used to take an in-depth look at your financial history. Hard searches are visible on your credit file for up to 12 months. Too many hard searches over a short period of time could have a negative effect on your credit score.

Pre-approval does not guarantee acceptance. If an eligibility check shows that you have been pre-approved for a loan, you will still need to undergo further checks, including a hard credit search, directly with the lender. Following further checks, the lender will decide whether to approve your application.

If you find yourself in this position, you should contact your lender as soon as possible and explain the situation. We understand that this can feel daunting, but they will want to work with you to find a solution.

No matter what financial challenges you might be facing, support is available. For free, impartial advice, visit Citizens Advice Bureau, MoneyHelper and National Debtline.

StepChange offer a free, online quiz where the answers you provide will generate advice to help you get back on track with your finances.

A secured loan is when you borrow a sum of money from a lender and 'insure' it against one of your assets, usually your home or car. This is known as 'collateral.' If you fail to repay your loan, the lender is within their rights to seize the collateral to recoup their losses.

Unsecured loans are not tied to an asset and, as such, they are viewed as riskier by the lender. This is why unsecured loans tend to come with higher interest rates than secured loans.